IVF Insurance Coverage State Checker

Which State Are You In?

Check if your state requires IVF insurance coverage as of 2025

Coverage Results

Select your state to see coverage details

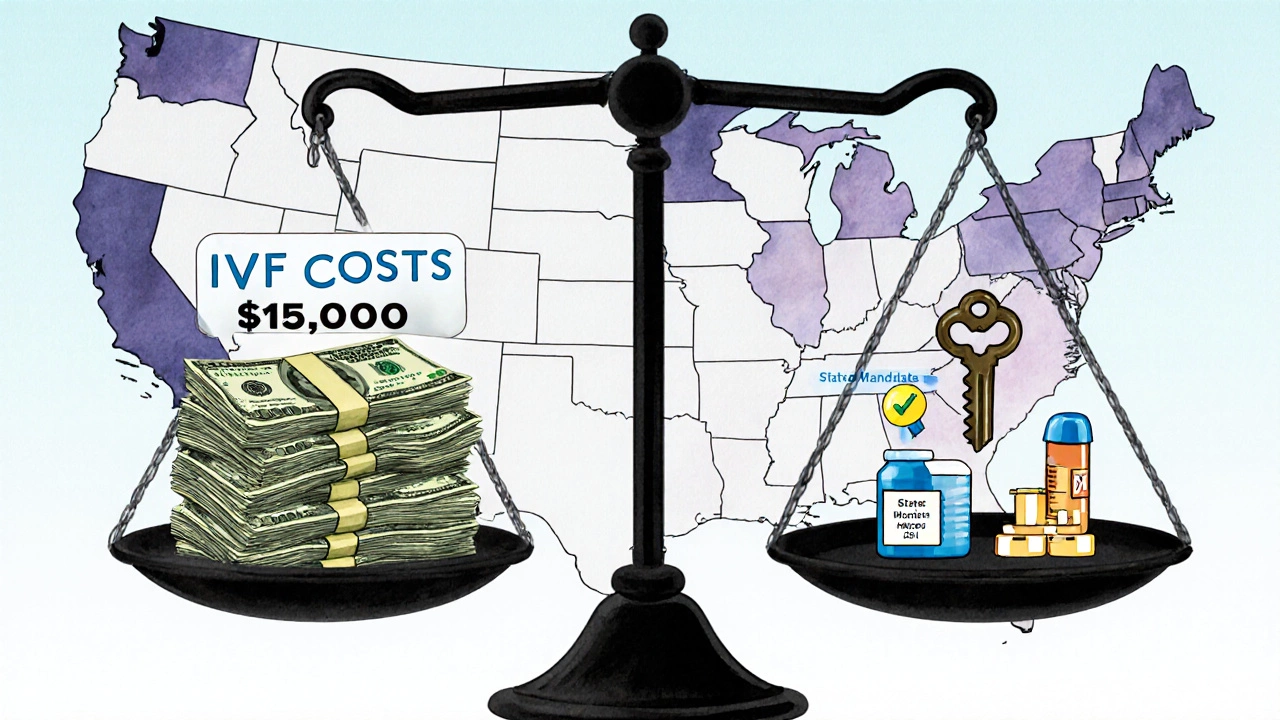

Trying to get pregnant through IVF is expensive. A single cycle can cost between $12,000 and $17,000 in the U.S., not including medications, which can add another $3,000 to $5,000. If you need multiple cycles - and many people do - the total can hit $50,000 or more. That’s why knowing which insurance covers IVF isn’t just helpful - it’s essential.

Does Any Insurance Cover IVF at All?

Not all insurance plans cover IVF. In fact, most employer-based plans in the U.S. still treat fertility treatment as an optional benefit - not a medical necessity. But that’s changing. As of 2025, 21 states require some level of IVF coverage for certain plans. These are called mandated states. If you live in one of them, your employer’s group plan (if it offers fertility benefits at all) must include IVF.

States with IVF coverage mandates include: Massachusetts, Illinois, New Jersey, New York, Rhode Island, Connecticut, Maryland, Ohio, West Virginia, Minnesota, and others. But here’s the catch: the mandates don’t apply to every plan. Self-insured plans (which are common among large companies) are exempt because they fall under federal law, not state law.

What Does IVF Coverage Actually Include?

Even in mandated states, coverage varies. Some plans cover only diagnostic tests. Others cover one or two cycles. A few cover unlimited cycles. You need to check your plan’s details carefully. Common inclusions:

- Initial fertility testing (hormone panels, ultrasounds, semen analysis)

- Medications for ovarian stimulation

- IVF procedure itself (egg retrieval, fertilization, embryo transfer)

- Freezing and storing embryos (cryopreservation)

- Genetic testing of embryos (PGT-A)

But here’s what’s often left out: donor eggs, donor sperm, gestational surrogacy, and multiple embryo transfers. These are usually considered extra and billed separately. Some plans cap the number of eggs retrieved or the number of embryos transferred per cycle.

How to Find Out If Your Insurance Covers IVF

You can’t assume your plan covers IVF just because you have health insurance. Here’s how to get the real answer:

- Call your insurance company. Ask: "Does my plan cover IVF? If so, what is covered and what are the limits?"

- Ask for the Summary of Benefits and Coverage document. Look for sections titled "Fertility Treatment," "Reproductive Services," or "Assisted Reproductive Technology."

- Check if your fertility clinic is in-network. Out-of-network providers may not be covered at all, or you may pay 50% more.

- Ask about pre-authorization. Many plans require you to get approval before starting treatment - skip this step, and you could be stuck with the full bill.

Don’t rely on your doctor or clinic to know your insurance rules. They often get it wrong. You’re the only one who can verify your coverage.

What If Your Insurance Doesn’t Cover IVF?

If your plan doesn’t cover IVF - or if you’re in a state without a mandate - you still have options.

Some employers offer fertility benefits as part of their wellness program, even if they’re not legally required to. Companies like Google, Apple, and Microsoft now offer up to $25,000 in IVF coverage. Check your HR portal or ask your benefits manager. Even small companies are starting to offer this as a perk to attract talent.

Some clinics offer payment plans or discounted packages for multiple cycles. For example, a clinic might charge $10,000 for one cycle, but $25,000 for three - that’s a 17% discount. Some also offer refund programs: if you don’t have a baby after a set number of cycles, you get most of your money back. These aren’t insurance, but they reduce financial risk.

There are also nonprofit grants and fundraising platforms like BabyQuest Foundation and Cade Foundation that help people pay for IVF. You can apply for these even if you have partial insurance coverage.

Medicaid and Medicare: Do They Cover IVF?

Medicaid generally does not cover IVF. Only a few states - Illinois and New York - use Medicaid funds to cover limited fertility treatments under very specific conditions, like for women under 35 with documented infertility. Even then, it’s rare and hard to qualify for.

Medicare doesn’t cover IVF at all. It’s designed for people over 65, and most people in that group are past their reproductive years. But if you’re under 65 and on Medicare due to disability, you still won’t get IVF coverage.

What About HSA or FSA Accounts?

You can use money from a Health Savings Account (HSA) or Flexible Spending Account (FSA) to pay for IVF. This isn’t insurance coverage - it’s tax-free money you’ve already saved. You can use it for:

- IVF procedure fees

- Fertility medications

- Genetic testing

- Cryopreservation

But you can’t use HSA/FSA funds for surrogacy, egg donation, or sperm donation - those are considered non-medical expenses. Also, you must have an HSA linked to a high-deductible health plan. If you’re not sure, check with your employer or bank.

Private Insurance vs. Employer Plans: What’s the Difference?

Private insurance plans you buy on your own - like through HealthCare.gov - rarely cover IVF. Even if they say they do, the coverage is usually minimal. Most of these plans are designed to be cheap, not comprehensive.

Employer-sponsored plans are your best bet. Even if your state doesn’t mandate IVF coverage, your employer might choose to include it anyway. Large companies often do. Smaller ones might offer it as a way to stand out in hiring. Always ask.

What About International Insurance or Travel for IVF?

If you’re considering going abroad for IVF - to countries like Spain, the Czech Republic, or Mexico - your U.S. insurance won’t cover it. You’ll pay out of pocket, and you’ll also need to cover travel, lodging, and follow-up care when you return.

Some people do this because the cost is lower. A full IVF cycle in Spain might cost $7,000 instead of $15,000. But there are risks: language barriers, different medical standards, no legal recourse if something goes wrong, and no follow-up care back home. Insurance doesn’t cover it - and neither does most U.S. medical advice.

What to Do Next

If you’re thinking about IVF, here’s your action plan:

- Confirm your state’s IVF coverage laws.

- Call your insurance provider and ask for written details about IVF coverage.

- Check if your employer offers any fertility benefits beyond insurance.

- Use your HSA or FSA if you have one.

- Ask your clinic about payment plans or refund programs.

- Look into grants or crowdfunding if you need financial help.

Don’t wait until you’re ready to start treatment to figure this out. The process of verifying coverage can take weeks. And if you find out too late that your plan doesn’t cover it, you might miss your best window for treatment.

Does Medicare cover IVF?

No, Medicare does not cover IVF. It only covers medical services for people over 65 or those with certain disabilities, and IVF is not included in its benefits. Even if you’re under 65 and on Medicare due to disability, you still won’t get IVF coverage.

Can I use my HSA for IVF?

Yes, you can use HSA or FSA funds to pay for IVF procedures, fertility medications, genetic testing, and embryo freezing. But you can’t use these accounts for donor eggs, donor sperm, or surrogacy. You must have an HSA linked to a high-deductible health plan to qualify.

Which states require insurance to cover IVF?

As of 2025, 21 states require some level of IVF coverage for certain insurance plans. These include Massachusetts, Illinois, New Jersey, New York, Rhode Island, Connecticut, Maryland, Ohio, West Virginia, Minnesota, and others. But the rules vary by state - some cover only one cycle, others cover multiple. Self-insured plans are often exempt.

Does Medicaid cover IVF?

Medicaid rarely covers IVF. Only Illinois and New York offer limited coverage under strict conditions - usually for women under 35 with documented infertility. Even then, approval is difficult and coverage is minimal. Most states do not fund IVF through Medicaid.

What if my insurance says it covers IVF but won’t pay?

If your insurance denies a claim for IVF that you believe should be covered, file an appeal. Get a letter from your doctor explaining why the treatment is medically necessary. Keep records of every call, email, and form. Many people win appeals by showing their plan violates state law or misinterprets its own policy. You can also contact your state’s insurance commissioner’s office for help.

Can I get IVF coverage if I’m single or in a same-sex relationship?

Yes. Most insurance policies that cover IVF don’t restrict it based on marital status or sexual orientation. If your plan covers IVF for heterosexual couples, it must also cover it for single people and same-sex couples under federal anti-discrimination rules. However, some plans still try to exclude these groups - if that happens, file a complaint with your state insurance department.

Final Thoughts

IVF is expensive, but it doesn’t have to be impossible. The key is knowing what your insurance actually covers - not what you hope it covers. Many people spend months in treatment only to find out later that their plan won’t pay for half of it. That’s avoidable. Take the time now to call your insurer, read your plan documents, and ask questions. You’re not just spending money - you’re investing in your future. Make sure you’re not wasting it.